Gold prices have seen notable fluctuations over the past year, driven by a combination of economic shifts, geopolitical developments, and investor sentiment. As a traditionally safe-haven asset, gold’s performance often reflects the underlying health of the global economy—and FY 2024–25 was no exception.

Key Highlights from the Year

Early 2024 – Steady Climb

Gold prices started the year on a steady upward path. With inflation concerns and ongoing interest rate adjustments by central banks, investors flocked to gold as a hedge, driving prices higher. The early quarters saw:

- Gradual price increases as markets reacted to economic uncertainties.

- A shift in investor preference toward safe assets amid volatile equities and currency movements.

Mid-Year Dip – Temporary Correction

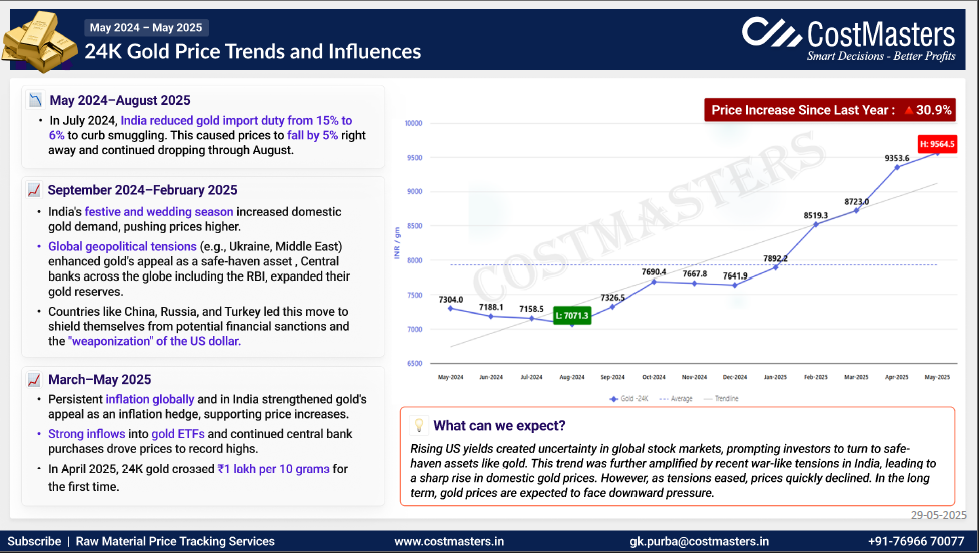

By mid-2024, gold prices experienced a temporary correction. This was due to:

- Strengthening of the U.S. dollar.

- Rising real interest rates, making non-yielding assets like gold less attractive.

- Increased confidence in economic recovery, which briefly reduced demand for safe-haven assets.

Late 2024 to Early 2025 – Bullish Turn

The final quarter of 2024 and early 2025 marked a strong rebound in gold prices:

- Escalating geopolitical tensions and trade uncertainties reignited demand.

- Persistent inflation concerns and renewed central bank buying added upward pressure.

- Global economic slowdown fears kept gold on the radar for both institutional and retail investors.

Overall Yearly Trend

Looking forward, gold is expected to retain its strategic importance in global asset allocations. Key factors influencing its trend include:

- Central bank rate decisions and inflation trajectories.

- Geopolitical developments and economic recovery pace.

- Demand from jewelry, technology, and institutional investment sectors