Introduction

Aluminium is a versatile metal which is used for construction, packaging and consumer goods as in widely used in various industries. In India, understanding the prices of aluminium is important for the industries which are working in these sectors. This blog will provide the insightful information about aluminium price trend in India, factors affecting the fluctuations and current market trends. We are updating the prices chart every month. If you want to track real-time prices, then please book a free demo with our customer representative.

Current Aluminium Prices in India

1. Balco Aluminium Prices Chart:-

In the chart above, we can see that the prices are Rs. 244.3/kg as of 30th September, 2024.

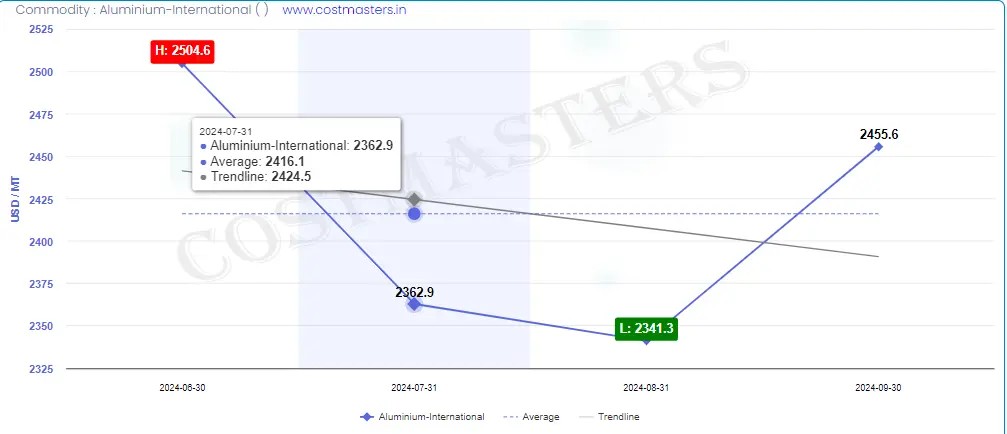

2. International Aluminium Prices Chart:-

In the chart above, we can see that the prices are USD 2455.6/MT as of 30th September, 2024.

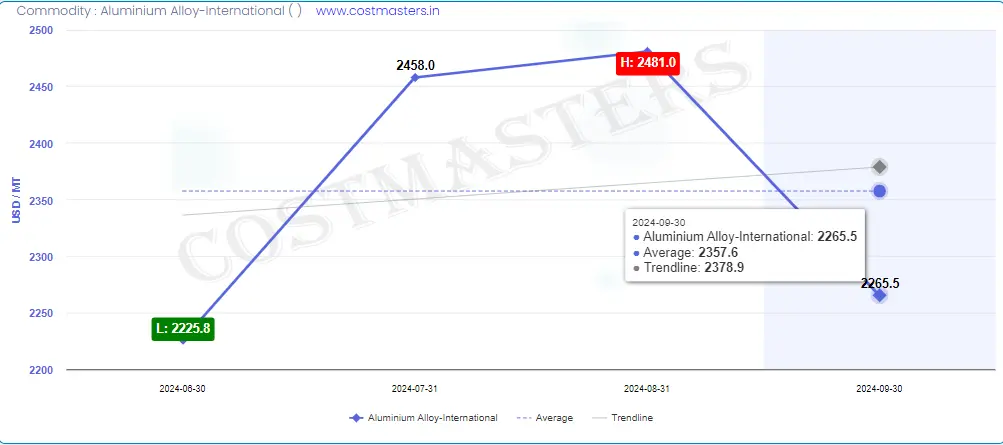

3. Aluminium Alloy International Prices Chart:-

In the chart above, we can see that the prices are USD 2265.5/MT as of 30th September, 2024.

4. Aluminium CG Ingot Prices Chart:-

In the chart above, we can see that the prices are Rs. 234.7/kg as of 30th September, 2024.

Factors Affecting the Price of Aluminium

There are many factors that affect the price of aluminium. These includes;

- Global Economic Conditions: Global economic growth, industrial activities and business policies are affecting the aluminium demand.

- Supply and Demand Dynamics: Balance between the demand and supply plays an important role in deciding the aluminium prices.

- Energy Costs: Aluminium Production is energy consuming process. As a result, the fluctuations in energy cost also affect aluminium prices.

- Geopolitical Tensions: Geopolitical instability, business troubles, and natural disasters could disrupt the supply chain and affect the aluminium prices.

- Technological Progress: Innovations in aluminum production and recycling technologies may affect supply and demand dynamics, and as a result can impact the aluminium prices.

Future Outlook for Aluminium Price in India

It is challenging to calculate the future price trend of aluminium because many factors comes under play when we are going to calculate the prices of aluminium. However, experts generally expect continued growth in aluminum demand globally which is driven by urbanization, industrialization, and the increasing use of aluminum in electric vehicles and also in renewable energy applications.

In India, Government’s focus on infrastructure development and expansion of the manufacturing sector can boost demand for aluminium. However, uncertainties related to global economic conditions, energy prices and geopolitical factors may impact the aluminum price outlook.

Conclusion

Aluminum price in India are affected by several domestic and global factors. Understanding these factors is important for businesses that depend on aluminum. By staying informed about the latest developments and trends, you can make informed decisions and can manage the aluminium related costs effectively.