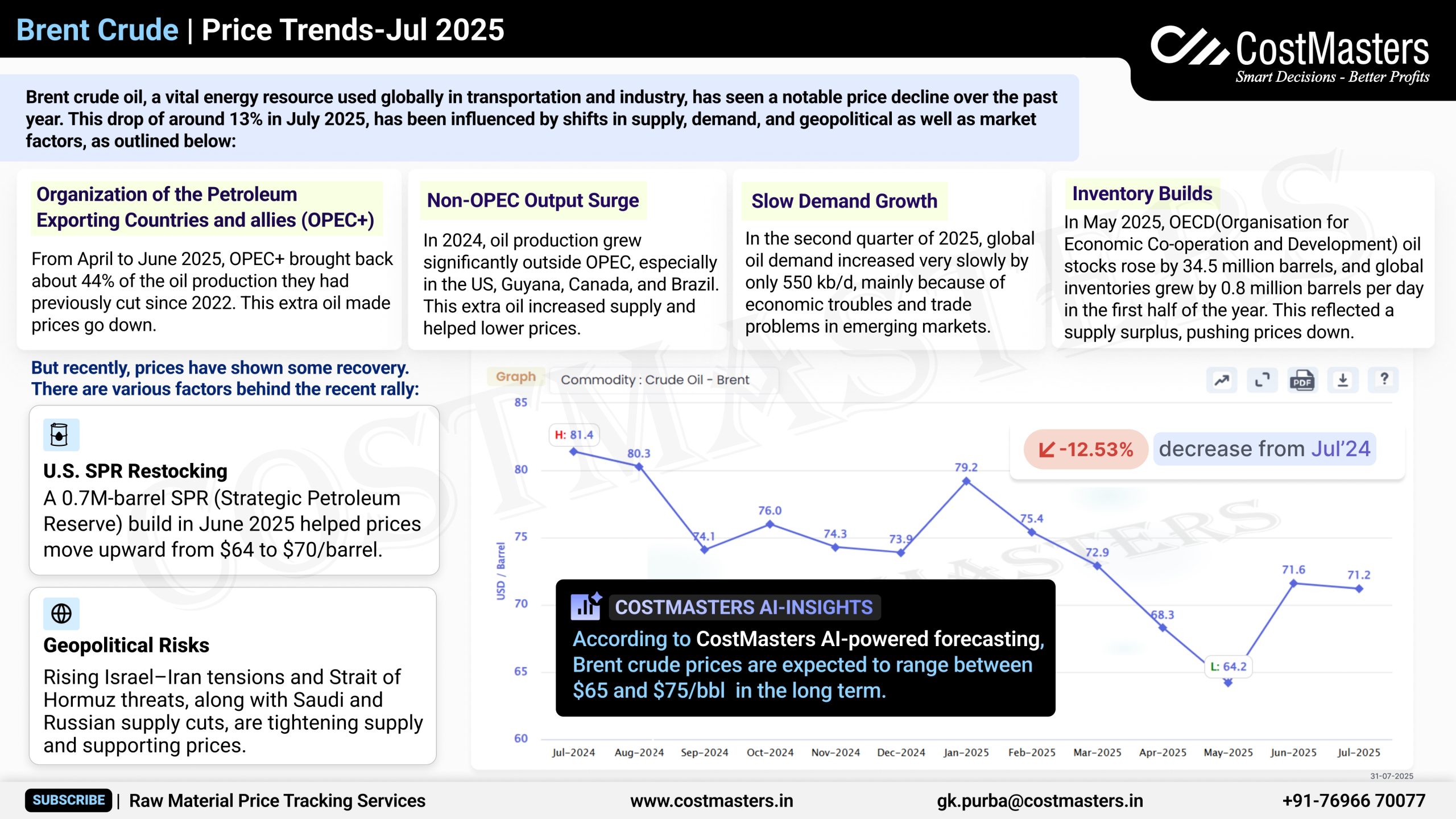

Brent crude — the go-to benchmark for oil prices worldwide — has hit a bit of a rough patch this year. As of July 2025, prices are down by around 13% compared to the same time last year.

So, what’s behind the dip?

It’s not just one thing — it’s a mix of too much oil, not enough demand, and growing stockpiles. Let’s unpack what’s really going on.

Why Are Oil Prices Sliding?

There’s Simply More Oil Than Before,For a while, major oil-producing countries — especially those in the OPEC+ group like Saudi Arabia and Russia — had been keeping production low to support higher prices. But now? They’ve started opening the taps again, bringing back about 44% of the oil they had held back since 2022.

Think of it like a faucet that was half shut to avoid flooding the market — now it’s slowly turning open again. And when there’s more oil flowing, prices tend to fall.

On top of that, countries outside OPEC — like the U.S., Brazil, Canada, and Guyana — are also ramping up production. With so much supply coming from all directions, it’s easy to see why prices are slipping.

Global Demand Isn’t Keeping Up

While supply is rising, demand hasn’t really caught up. In the second quarter of 2025, global oil use rose by just 550,000 barrels per day. That’s not a lot — especially when compared to the spike in production.

Why so slow ? A lot of it comes down to economic challenges and trade slowdowns, especially in emerging markets. When economies are struggling, they use less energy — and less energy means less oil.

Stockpiles Are Growing Too

Adding to the price pressure: oil inventories are climbing. In May 2025, oil stocks in OECD countries rose by 34.5 million barrels, and on a global scale, storage grew by around 0.8 million barrels per day during the first half of the year.

In simple terms: oil is being produced faster than it’s being used — and it’s piling up in storage tanks around the world. That’s another signal that prices might need to drop before the market balances itself out.

Is There a Light at the End of the Tunnel?

Yes — there are signs of a short-term recovery, even if the road ahead remains bumpy.

In June 2025, the U.S. government added 0.7 million barrels to its Strategic Petroleum Reserve (SPR). That move helped nudge prices upward — from around $64 to $70 per barrel.

Meanwhile, rising tensions in the Middle East — particularly between Israel and Iran, and fresh concerns about the Strait of Hormuz — are making the market a little more cautious. Add to that supply cuts from Saudi Arabia and Russia, and the stage is set for a bit of a rebound.

The Outlook

According to CostMasters‘ AI-powered forecast, Brent crude is expected to stabilize between $65 and $75 per barrel in the long run. That suggests that while we might not see major spikes anytime soon, the worst of the decline could be behind us — assuming no major surprises.

Final Thoughts

The oil market is complex — it reacts not just to barrels and numbers, but to politics, economies, and even psychology. Right now, it’s facing a classic imbalance: too much supply, not enough demand, and uncertainty about where it’s all headed. For now, expect some volatility, but also the possibility of stabilization as the market finds its footing.