From Electric Vehicle Batteries to Glass, Modern Manufacturing Runs on Lithium,

A critical industrial metal with unique properties that make it indispensable for producing ceramics, lubricants, specialty alloys, and more across a wide range of industries.

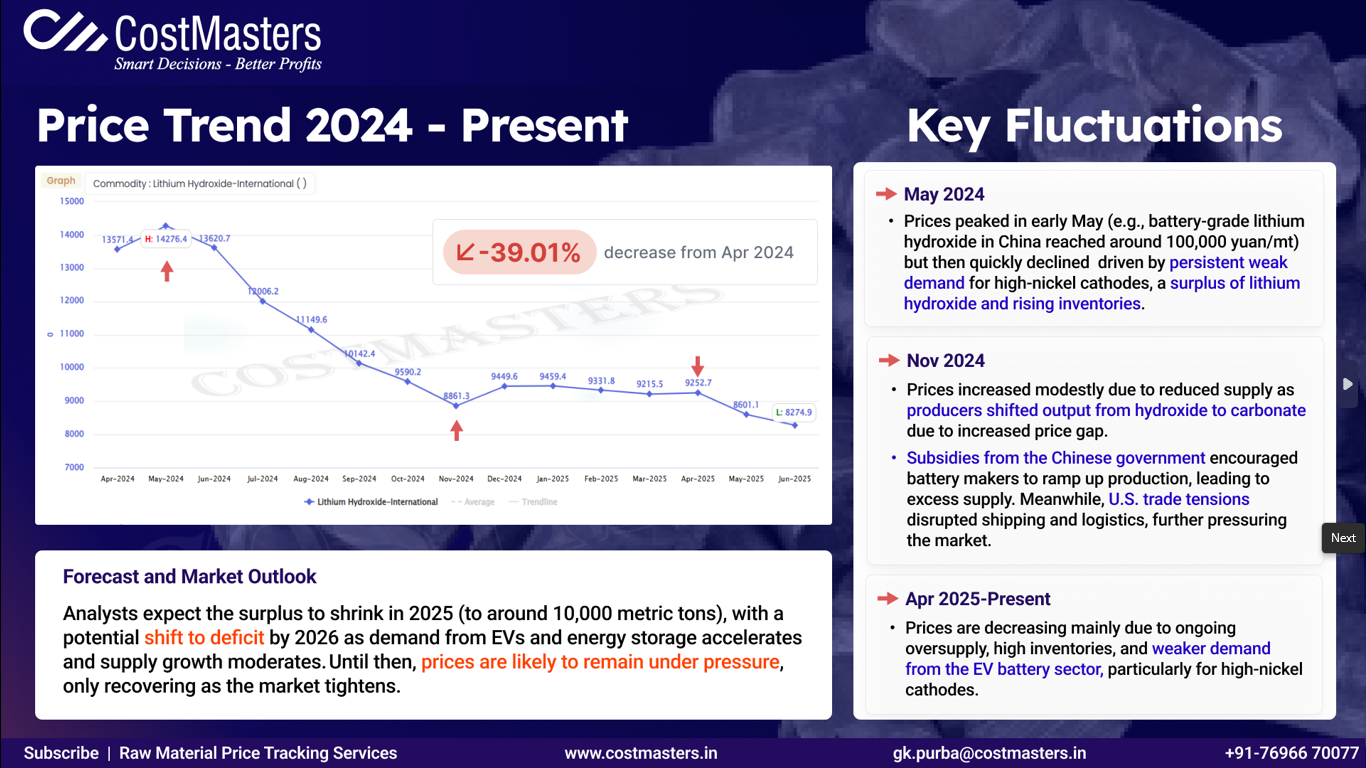

Price Trend 2024 – Present

Key Fluctuations

➡️ May 2024

- Prices peaked in early May (e.g., battery-grade lithium hydroxide in China reached around 100,000 yuan/mt) but then quickly declined

- Driven by:

- Persistent weak demand for high-nickel cathodes

- Surplus of lithium hydroxide

- Rising inventories

➡️ Nov 2024

- Prices increased modestly due to reduced supply as producers shifted output from hydroxide to carbonate

- Subsidies from the Chinese government encouraged battery makers to ramp up production → excess supply

- U.S. trade tensions disrupted shipping/logistics → additional pressure

➡️ Apr 2025 – Present

- Prices are decreasing due to:

- Ongoing oversupply

- High inventories

- Weaker demand from the EV battery sector, especially for high-nickel cathodes

Forecast and Market Outlook

Analysts expect the surplus to shrink in 2025 (to around 10,000 metric tons), with a potential shift to deficit by 2026 as demand from EVs and energy storage accelerates and supply growth moderates.Until then, prices are likely to remain under pressure, only recovering as the market tightens.