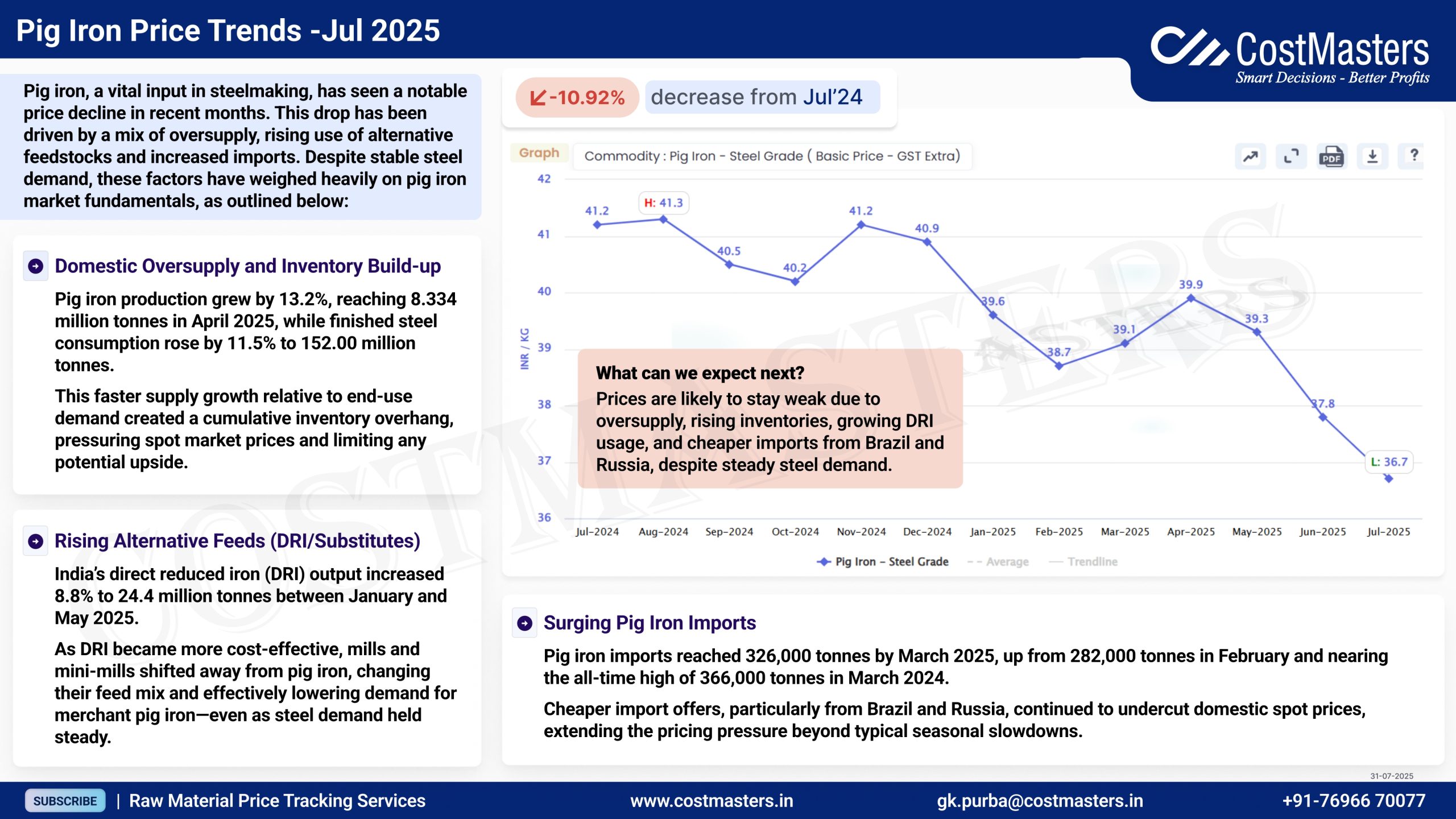

The pig iron market — a key input for steelmaking — has been under pressure lately. Prices have dropped by nearly 11% compared to July 2024, despite stable demand from the steel industry. So, what’s dragging the market down ? Let’s take a closer look.

Domestic Production Outpaced Demand

Pig iron production in India jumped by 13.2%, reaching 8.334 million tonnes in April 2025, while finished steel consumption rose by a slightly slower 11.5%.

This faster growth on the supply side has led to an inventory pile-up. With more pig iron available than needed, spot prices have taken a hit, and there’s little room for them to climb unless demand picks up.

Shift Toward Alternative Feeds

India’s Direct Reduced Iron (DRI) output also rose by 8.8% (to 24.4 million tonnes between January and May 2025). As DRI has become a cheaper and more efficient feedstock, many mills and mini-mills are choosing it over pig iron, reducing the latter’s demand — even though overall steel demand remains steady.

Imports Are Weighing Down Prices

Pig iron imports touched 326,000 tonnes by March 2025, up from 282,000 tonnes the month before — and inching close to the record high of 366,000 tonnes set in March 2024.

Brazil and Russia are leading the way in offering cheaper imports, which have made it even harder for domestic suppliers to maintain pricing power. The usual seasonal slowdowns are being made worse by these aggressive international offers.

What’s Next?

Looking ahead, the market isn’t showing signs of bouncing back just yet. According to current trends:

“Prices are likely to stay weak due to oversupply, rising inventories, growing DRI usage, and cheaper imports — even though steel demand remains stable.”

Final Thoughts

The pig iron market is facing a tough combination of rising domestic production, shifting buying patterns, and import competition. Unless there’s a major shift in steel demand or policy interventions to curb imports, pig iron prices may remain under pressure for the foreseeable future