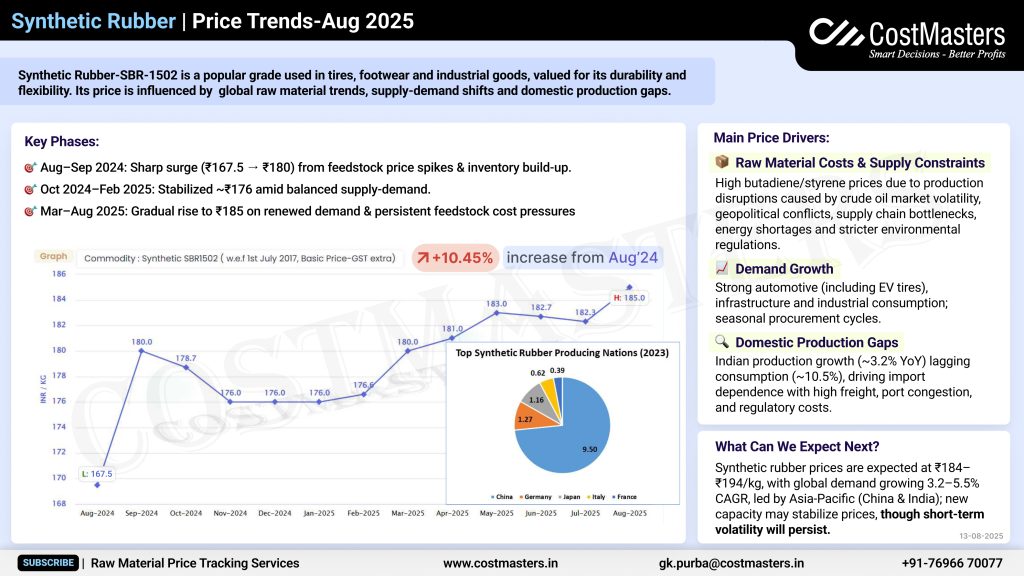

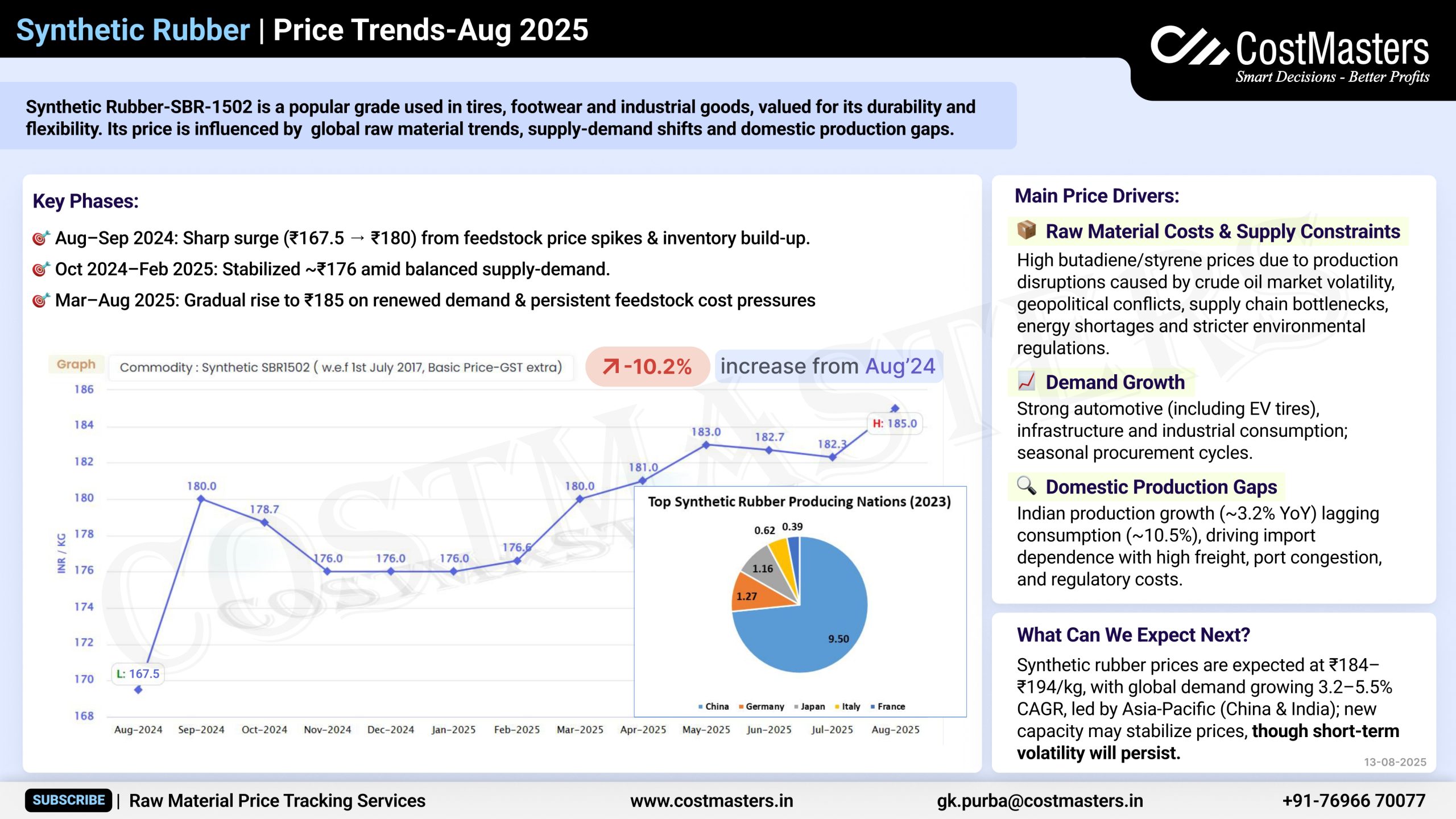

Synthetic Rubber (SBR-1502), widely used in tires, footwear, and industrial goods, continues to reflect dynamic shifts in pricing, influenced by raw material trends, demand cycles, and domestic supply gaps. The latest data from CostMasters highlights how synthetic rubber prices have moved through distinct phases over the past year.

Key Phases in Price Movement

- Aug–Sep 2024: Prices witnessed a sharp surge, climbing from ₹167.5 to around ₹180. This spike was primarily driven by feedstock price increases coupled with inventory build-up.

- Oct 2024–Feb 2025: The market entered a more stable phase, averaging around ₹176, indicating a balance between supply and demand.

- Mar–Aug 2025: Prices gradually rose to ₹185, sustained by ongoing feedstock cost pressures.

Overall, synthetic rubber prices recorded a +10.45% increase from August 2024 to August 2025.

Market Drivers Behind the Trends

The price movements are closely tied to several underlying factors:

- Raw Material Costs & Supply Constraints

Production disruptions in butadiene and styrene supply chains, coupled with volatile crude oil markets and logistical bottlenecks, have heightened cost pressures. - Demand Growth

Strong demand across tire manufacturing, infrastructure, and industrial consumption has supported upward price momentum. - Domestic Production Gaps

With Indian production contracting by 3.2% year-on-year and lagging consumption (at ~1.05 LTS), the dependency on imports remains high. This gap is further widened by freight costs, port congestion, and regulatory issues.

Global Production Snapshot

According to 2023 data, synthetic rubber production is concentrated among a few major countries :

- China dominates with the largest share.

- South Korea and Japan follow as significant producers.

- USA also plays an important role in global supply.

- Other contributing nations make up the balance.

This distribution highlights the reliance of importing countries, including India, on these key producers for meeting domestic demand.

Outlook Ahead

Looking forward, synthetic rubber prices are expected to range between ₹184–₹194/kg. Global demand growth, projected at 3.2–5.5% CAGR, led by Asia-Pacific (notably China and India), will likely keep the market active. While production capacities may stabilize prices, short-term volatility cannot be ruled out.