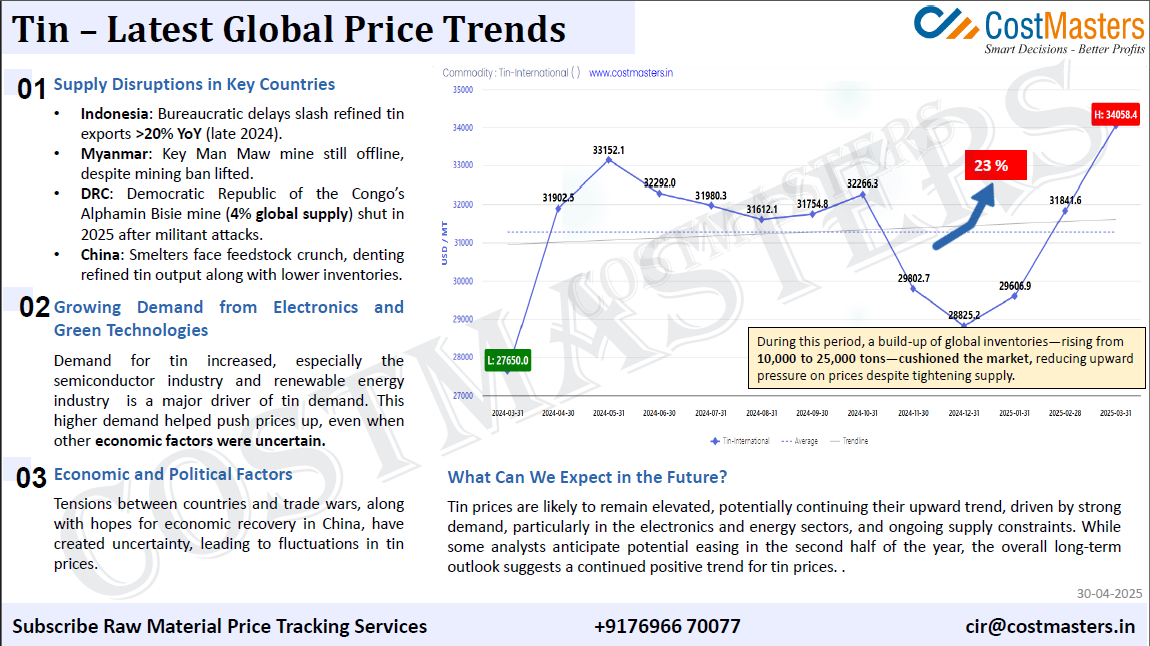

Supply Disruptions in Key Countries

One of the main drivers of tin prices in recent times has been the supply chain disruption in major tin-producing countries :

Indonesia: Bureaucratic inefficiency has resulted in >20% YoY fall in refined tin exports by end-2024.

Myanmar: In spite of an official end to a mining ban, the major Man Maw mine continues to be shut down.

Democratic Republic of the Congo (DRC): The Alphamin Bisie mine shutdown, which represents 4% of world supply, in 2025 because of militant attacks added pressure to world supply.

China: Local smelters are facing a feedstock shortage, sharply reducing refined tin production and declining inventory levels.

Booming Demand for Electronics and Green Technologies

The demand for tin has surged, mainly fueled by Semiconductor industry growth, growing use of renewable energy technologies, these industries are driving increased demand for tin, driving prices up even in the context of overall economic uncertainty. The technological demand for tin, which is applied in soldering and circuit boards, keeps expanding and drives it as a strategic material in today’s industrial economy.

Economic and Political Factors

Global tensions and policy changes are also contributing, Increasing trade wars and geopolitical tensions, Uncertainty over China’s economic recovery. These elements have added volatility to the tin market, impacting investor sentiment and pricing dynamics.

What Can We Expect in the Future?

In the future, tin prices are set to continue being high. This is projected to be supported by robust demand from the electronics and renewable energy industries. Persistent supply bottlenecks in major mining areas although some analysts forecast a possible weakening in the latter part of the year, the long-term perspective remains bullish, with supportive price momentum seen for tin.