The recent few years have seen significant fluctuations in the aluminium price trend, which are attributed to a variety of factors such as global economic conditions, political disputes and technological developments. However, during 2024 we have witnessed several identifiable forces that have caused aluminium prices fluctuations.

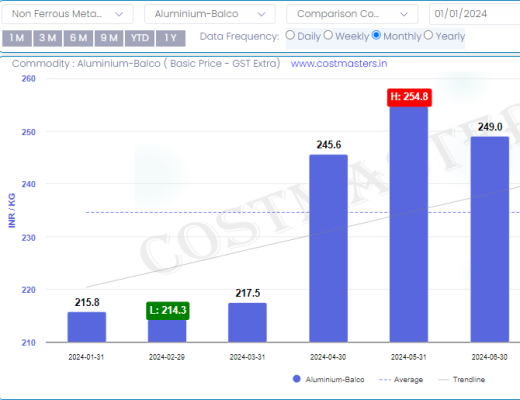

Current Aluminium Price in India

Before we look at the driving factors, it is crucial to know where the prices of current aluminium price. Though difficult to make definitive predictions some insights can be gleaned from recent market moves. By February 2024 the Aluminium-International prices was up decreased from 2259.5 USD/MT in December 23 to 2202.9 USD/MT in March 24.

Factors Potentially Dampening Prices

Despite this bearish aluminium price trend, the aluminium price trend in India and globally will depend on various factor mentioned below.

- Fluctuation in Production Levels: Aluminium production worldwide will play a significance role in the to balance the supply demand scenarios. China which is the largest world producer might increase aluminium production as their economy is showing recovery from various crisis. Therefore, oversupply could drag prices down.

Aluminium prices depend upon the supply and demand in the international market. In the near future, aluminium will play a crucial role to maintain the balance.

We all know that China is the biggest producer of aluminium. In the recent times, China’s economy is still recovering. Amid this, aluminium production can increase. If this happens then the supply of aluminium can increase and we can see fall in the aluminium prices.

Let us Understand This in More Details

If the aluminium’s demand becomes more than it’s supply then the prices of aluminium increases because the producers can charge more for the limited aluminium. On the other hand, if the demand decreases and supply increases then the prices of the aluminium decrease.

1. China’s Importance: China is biggest producer of aluminium. Manufacturing in China affects the aluminium prices worldwide. If China increases the manufacturing, then the prices will automatically fall due to increase in supply.

- Economy Importance: If the economy of China becomes more stronger then it will have positive impact on the aluminium prices. As a result of better economy, the prices will fall due to the increased production.

2. Global Economic Slowdown: Concerns about a worldwide economic slowdown are on the increase. Reduced economic activity could reduce the amount of aluminum used in various industries, such as building and transportation. This would result in an excess supply of aluminum and can result in downward aluminium price trend.

In the near future, world economic slowdown is becoming a more concerned subject. If the world economic slowdown actually happens then it will definitely affect the aluminium prices. Let us discuss it more deeply,

- Decrease in Economic Activities: Due to the economic slowdown, economic activities also slow down. It means that the use of aluminium will reduce in manufacturing, transportation and also in other businesses.

- Excessive Supply: If demand reduces and supply increases then also the prices fall. This can happen in any commodity case.

- International Trade: If world economy really slows down then it will definitely affect the international trade. Due to this, the transportation of aluminium can reduce. This can lead to reduced aluminium prices in the domestic market due to increased supply in domestic markets.

3) Geopolitical Tensions: The current Russia-Ukraine war has affected supply chains and caused instability in the aluminium price trend in India and globally. However, unless the conflict directly affects major production facilities, its long-term impact on prices may be limited.

Today if we see that there is a great fluctuation in the aluminium prices, one of the major reasons for this is war between Russia and Ukraine war.

Let us understand more that how this war is affecting the aluminium prices;

- Supply Chain Disruption: Also, the war has raised another trouble of disruption of supply chain. It means that it becomes very difficult to move aluminium from one place to another. Due to this, aluminium supply can be limited and also leads to increased aluminium prices.

- Environment of Instability: Due to war, there is an environment of instability. Businessmen can’t judge whether the prices of aluminium will go up or down. Also they don’t know how will be the supply of aluminium in future.

- Long Term Effects may be Limited: If war does not directly impact te manufacturing sectors then it will have a long-term effect on aluminium prices. Once the supply chains become normal then the aluminium prices can also become stable.

4) Substitute Materials: There is competition for aluminium by alternative materials like steel and composites. Any progress made regarding these other options or even any substantial reduction in costs associated with them might lead to consumer preference change thus impinging on aluminium demand as well as its price.

Aluminium is a commodity that has multiple uses. But it doesn’t mean that there is no other option in the market. Let us have a look over the things that can affect the supply and demand of the aluminium prices,

- Replacement Material: The metals like steel and composite materials and also the aluminium alloys can be used as the option as the replacement for the aluminium. For example, some parts of car were manufactured by using aluminium but now people are using light steel instead aluminium.

- Reduction in Cost of Options: If these alloys and composite material’s production cost reduces then businessmen can definitely select these materials over the aluminium. When there are alternative materials present in the market then it can lead to decrease in aluminium prices.

- Advancement in Technology: Scientists are continuously testing new composite materials and light steel. If they are able to create the light and better composite material with better properties then it can proven to be a bigger obstacle for aluminium.

At the end, we can’t say that these replacement materials can completely replace the aluminium in the market because aluminium has its own benefits like it is light and easy in moulding.

5) Energy Costs: Aluminium production demands high energy levels. Variations in energy charges especially can bring changes in production expenses which may ultimately push down aluminium price trend. Aluminium manufacturing is one of energy consuming processes. In the aluminium production, electricity consumption is very large. As we all know that electricity prices will always fluctuate. These prices can go up and down any time. So, let us see in details that how the aluminium prices will be affected by the energy,

- High Energy Cost and High Production Cost: For aluminium production, the aluminium price depends upon the aluminium production as well.

- Increase in Electricity Prices, Increase in Aluminium Prices: If the electricity prices go up then the aluminium prices will automatically go up. This is because the producers can charge according to their need if they produce the aluminium at high electricity cost.

- Decreasing Electricity Prices leads to Decrease in Aluminium Prices: On the other hand, if the electricity prices go down then the aluminium prices can also go down.

- Now it is also very important to note that the only electricity prices will not only affect the aluminium prices, also there are some another factors,

- Other Raw Material (Oil, Gasoline, Plastic, Natural Gas, Coal etc.): Oil is very important ingredient in the raw material cost because it directly influences the transportation cost.

Coal is also a major cost contributing factor in the electricity production. Coal is not a very big constituent in the electricity production but still it has big participation on the electricity production.

6) Sustainability Concerns: Pressure from stakeholders to adopt more sustainable practices is increasing within the aluminum industry. In the short run, this could increase production costs but it might also create a premium market for “green” aluminium which will have an effect on overall price dynamics.

CostMasters Helps You Track Commodity Price Tracking Daily

CostMasters is an India based company that tracks over 200+ commodities. If we talk about the major targeted industries of CostMasters then these industries are Automotive OEM’s, Auto Components Manufacturer, Engineering OEM’s, Home Appliances Manufacturer, Electrical Equipment Manufacturer, Earthmoving & Agricultural Machinery etc.

What CostMasters provide in raw material price tracking services?

The major advantage of CostMasters raw material price tracking services is that the data is shown in graphical form so that all the data should be analysed very easily and it can be interpreted very easily. All the data is created and updated by professional domain experts. The price is also reasonable. Also, we have built-in analytics to see broader perspective.

- Monthly CIR Report (Cost Intelligence Report in PDF covering 3 years trend & analysis)

- Web Access (Online RM Price Data with custom range & selection with built-in analysis)

- Web Access + CIR (Combination of Web Access + CIR)

These commodities include various commodities as follows;

- Ferrous Alloys

- Non-Ferrous Alloys

- Steel

- Plastic

- Alloy Steel

- Rubber

- Fuel Energy

- Currency

- Manpower

Conclusion

The prediction for aluminium prices is not clear. It was a bearish time at the beginning, but the above factors indicate that there may be some price corrections in the second half. The ultimate determinant of this path is the interplay between supply and demand, economic conditions and geopolitics.