India’s steel sector witnesses the remarkable growth from 1 million tonnes production in 1950 to 2nd largest producer with the capacity to produce the 125 MMT steel. Both privet and government player played their parts.

In past few year India’s steel industries faced lots of challenges like fluctuated in commodities price, demand supply constrained despite having these challenges the steel production in India grows by 5.80.

This article delves into the steel industry, shedding light on the key players, their production capacities, import-export dynamics, and the challenges they encounter. Stay tuned for comprehensive insights, including the latest trends and factors influencing steel prices in India.

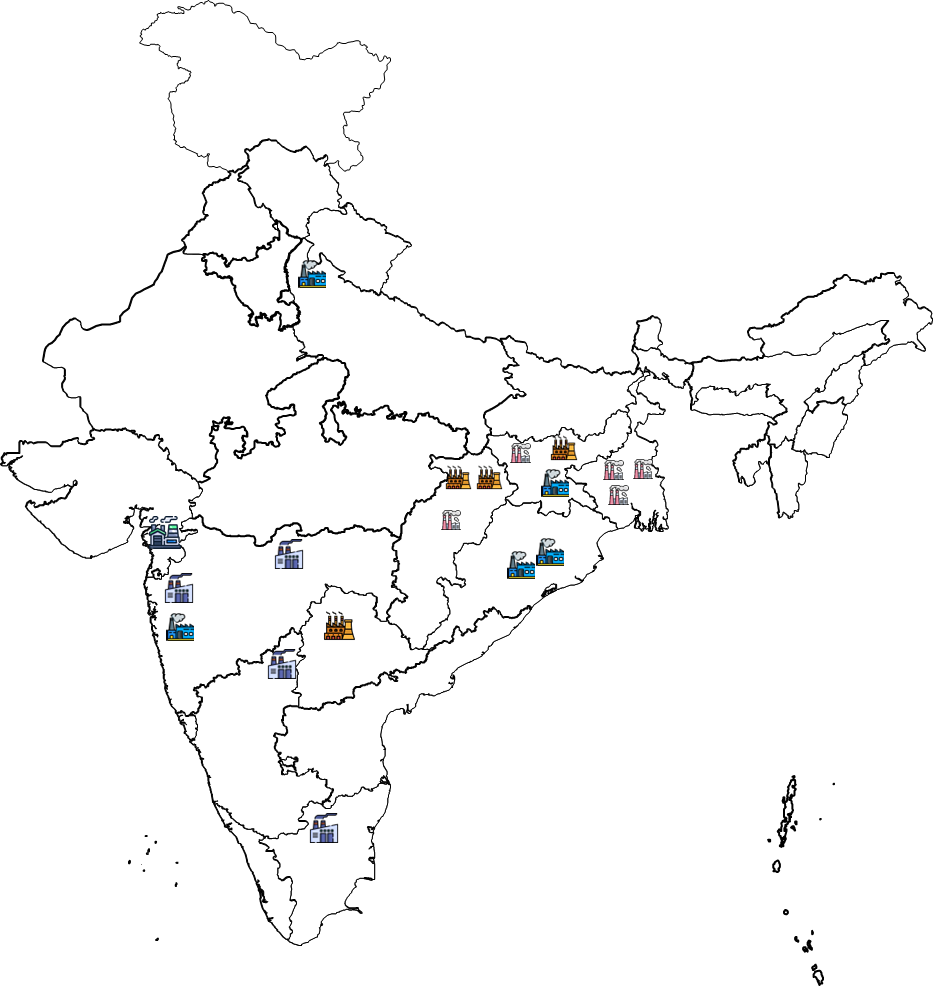

Major Steel players in India

TATA Steel Pvt. Ltd.

TATA Steel is one of the leading steel manufacturers in India.It has massive capacity of 21 MMT in India and around 11 MMT overseas. TATA Steel plans to complete the expansion by 2030.

Steel Authority of India Ltd.

SAIL set up on 19 January 1954, it is one of the largest steel-making companies in India and one of the Maharana’s. Company has capacity of 21 MTPA in India and plans to increase crude steel capacity to 50 MTPA as part of Vision 2030.

JSW steel Pvt. Ltd.

JSW Steel Ltd is an Indian multinational steel making company based in Mumbai, the current installed capacity of the company stands at 18 MTPA. In FY 21, Company generated total revenue of US$19 billion and plan to a target of achieving 37.5 MTPA steel capacity by FY25.

Jindal Steel and Power

JSPL is an Indian steel and energy company based in New Delhi with the capacity of 9.6 MTPA the company’s vision with an investment of 12 billion USD across the globe.

Essar Steel

Essar Steel is a global producer of steel with a footprint in India, the Middle East and Asia with a current capacity of 10 MTPA. Essar Steel India Limited was acquired by ArcelorMittal Nippon Steel India Limited.

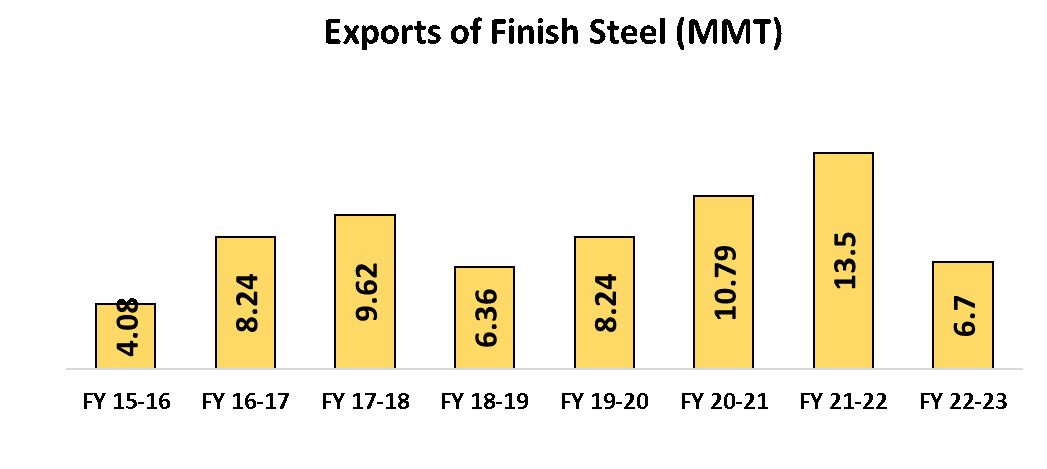

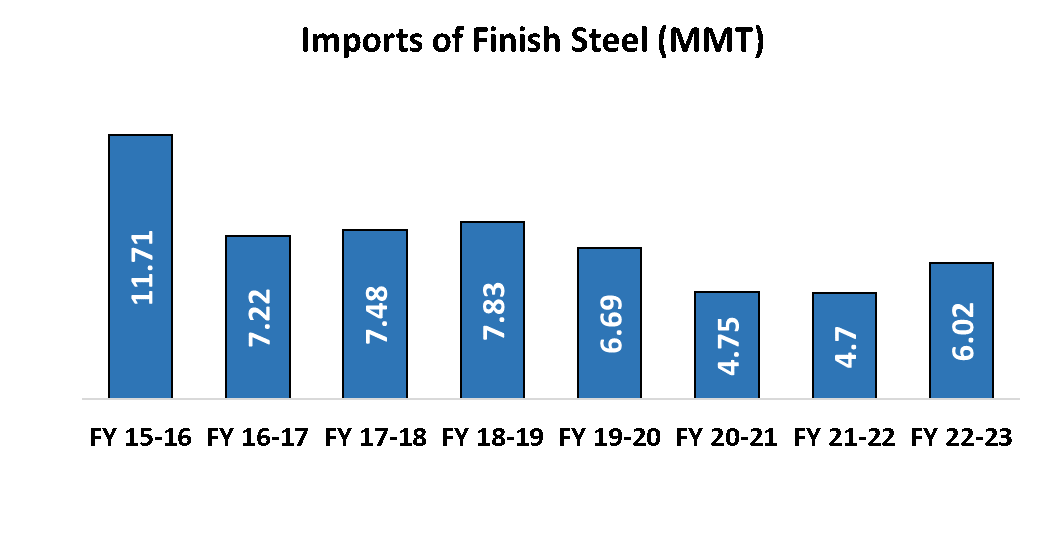

Import and Export of Steel

India is a net exporter of steel and totally depended on domestic production. The top destinations for export are Vietnam, UAE, Turkey and the top destinations for imports are South Korea, China and Japan.

As India is net exporter of steel, the steel price heavily relies on domestic production and the balance between domestic demand and supply within the country.

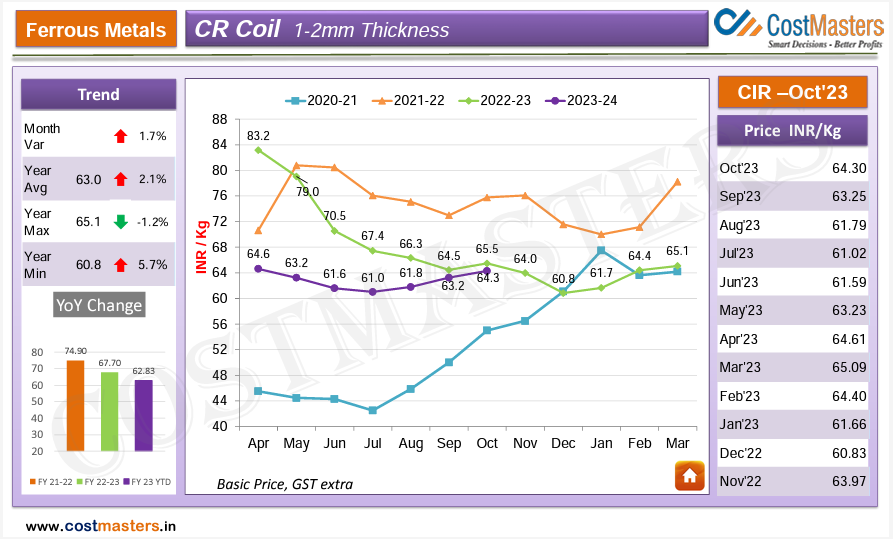

Steel Price in India

Steel price in India have shown a continues decline in prices since Apr’22 from 83.2 INR/Kg to 64.3 INR/Kg in Oct’23. There are various factors which contribute in this decline.

Commodities Price:

Coking Coal: India meets 85 % of its coking coal demand, key raw material for steel production from imports. The coking coal prices in international market fall from $457.80/Tonne in Sep’22 to $130/Tonne in Oct’23.

Iron Ore: The iron ore prices are decreasing from 5600 INR/ Tonne in Feb 2022 to 4660 INR/ Tonne in Oct’23

Supply & Demand Factors

Lower International prices:

The surge in steel manufacturing capacity coupled with a decrease in local demand in China has led to an oversupply of steel, subsequently contributing to lower steel prices in the international market. For a more in-depth understanding of these market dynamics and trends, including insights from a comprehensive steel prices chart, turn to reliable sources for up-to-date information and analysis.

Lower production and demand in Europe:

Economies within the European Union are experiencing a slowdown in manufacturing due to the high energy demands of these activities. This deceleration is a consequence of Europe’s decision to reduce its reliance on cheaper Russian energy supplies, opting instead for more expensive alternatives, which has affected manufacturing operations further cause decline in commodities price and steel prices.

Future Outlook of Steel Price in India

In the shorter term, the steel price (CR Coil) will range between 62 and 67 rupees per kilogram. As the global economy recovers from its slowdown, this could boost demand for steel, potentially leading to increased steel prices.

Challenges with Steel Industries in India

Lack of Capital

Steel industry is a capital-intensive sector. To establish a new steel plant with good capacity, steel companies need large amount of capital which is difficult to arrange in India.

Dependency on Imports of Coal

India gets its 85 % of cooking coal demand via imports, majorly from Australia and Russia. Price is dependent of geopolitical situation and forex movements.

Low Productivity

The per capita labour productivity in India is 90-100 tonnes annually which is one of the lowest at global comparison. The labour productivity in Japan, Korea and some other major steel producing countries is about 600-700 tonnes per man per year.

Inferior Quality of Products

Lack of modern technology adoption, high capital inputs and weak infrastructural facilities leads to time consuming expensive steel production and yields inferior variety of goods. Such a situation forces us to import better quality steel from abroad. Thus, there is urgent need to improve the situation and take the country out of desperate position.

Lack of Technology

Due to less investment in technological development, productivity in India is still very low as compare to other developed nations. In Japan and Korea, less than 1.1 tonnes of crude steel are required to produce a tonne of saleable steel. In India, the average is still high at 1.2 tonnes around 10% higher.

Adaptation of green steel:

Green steel is steel produced with a lower environmental impact than traditional steel production methods. Green steel production methods typically use less energy and emit fewer greenhouse gases. India is a challenging market for green steel because of low demand, greater manufacturing costs, and consumer preference for traditional steel, which is less expensive. Concerns over the carbon footprint and increased cost also prevent the product from being widely adopted in the market.

Conclusion:

India’s steel sector has changed dramatically over time, going from being the country’s small manufacturer to the second-biggest in the world. A number of variables, including government assistance, investments from the private sector, and a strong home market, have contributed to this expansion. The business does, however, also confront a number of difficulties, such as a lack of funding, a reliance on imported coal, low productivity, and subpar product quality. Notwithstanding these obstacles, India’s steel industry has a bright future because to the country’s increased emphasis on sustainable steel production and the country’s robust demand from the infrastructure and building sectors. The demand for steel is anticipated to stay high as the world economy expands and India’s infrastructure requirements rise, offering a strong platform for the industry’s future expansion and advancement.